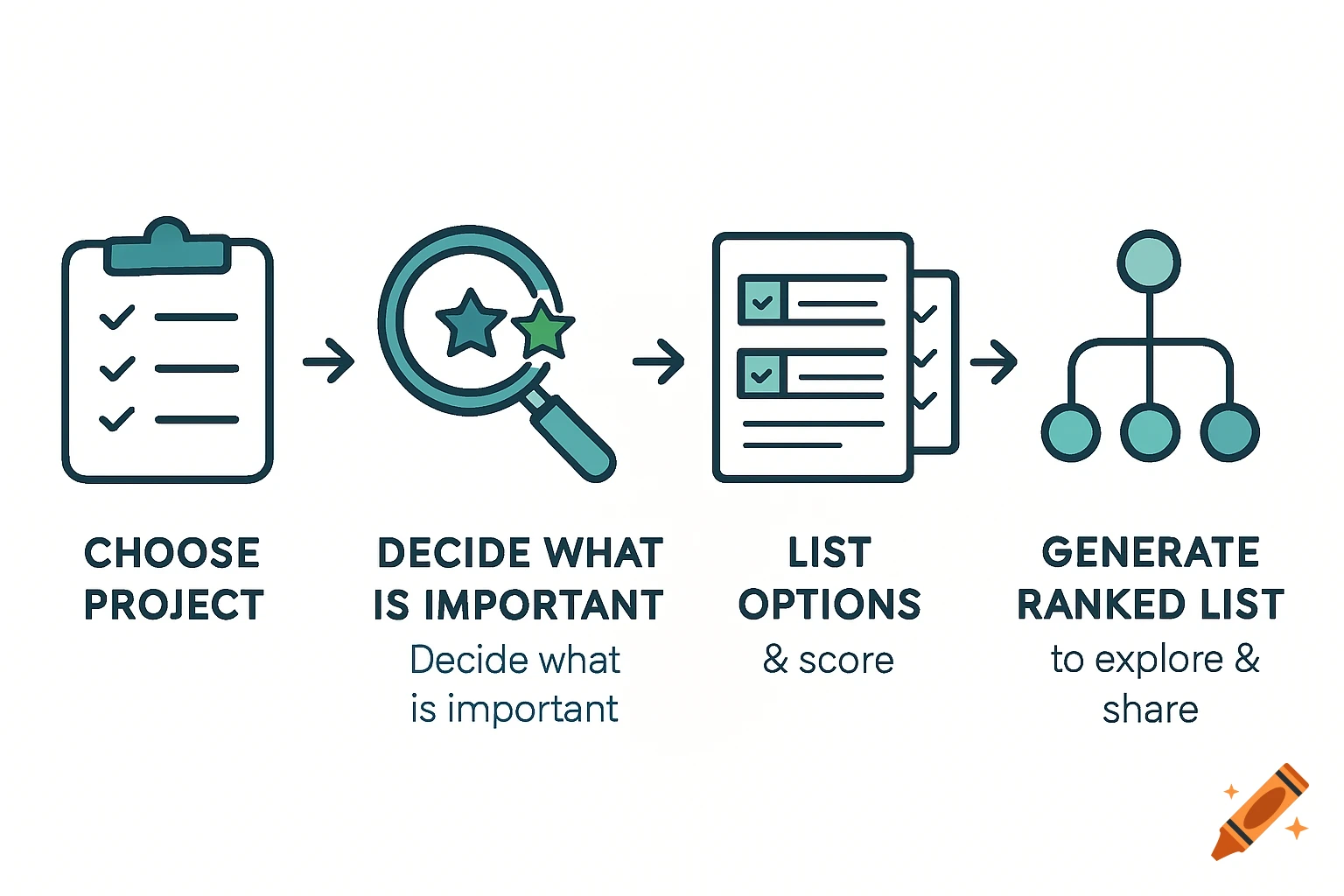

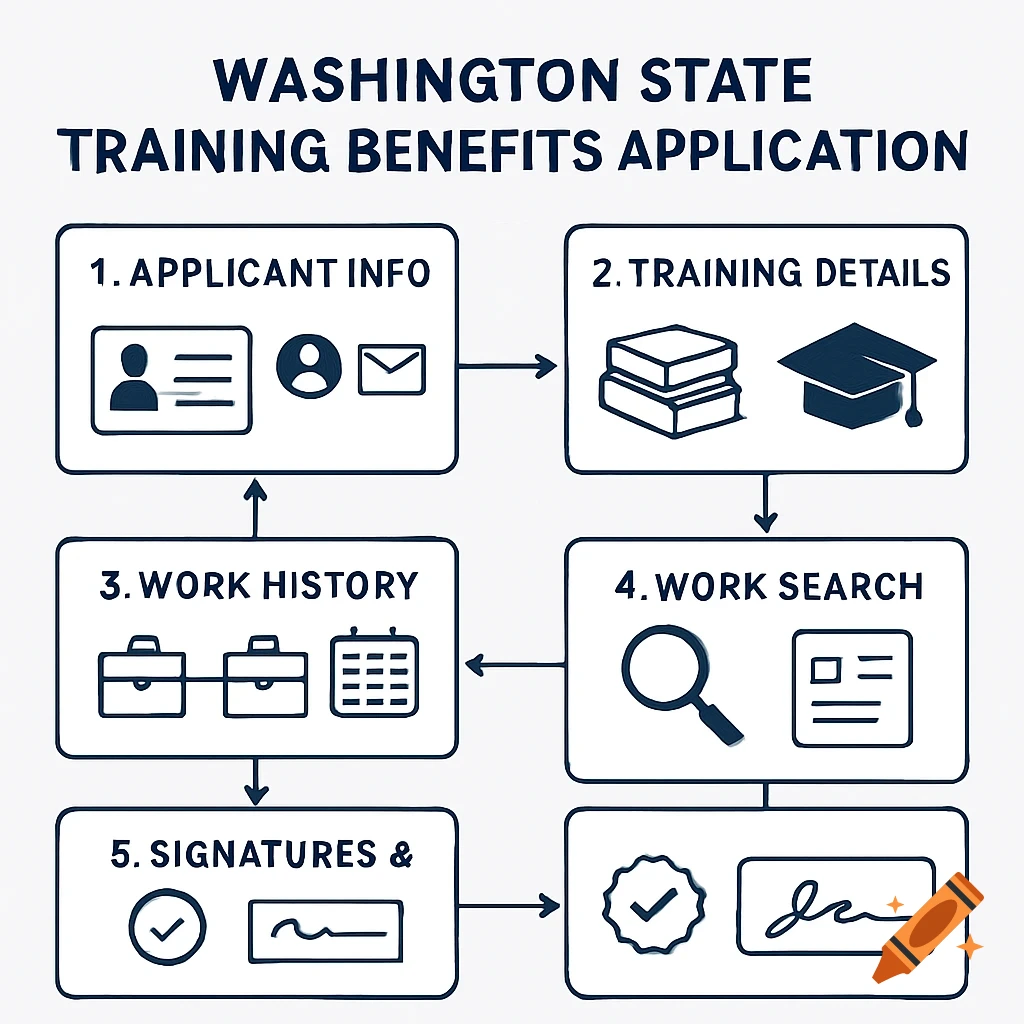

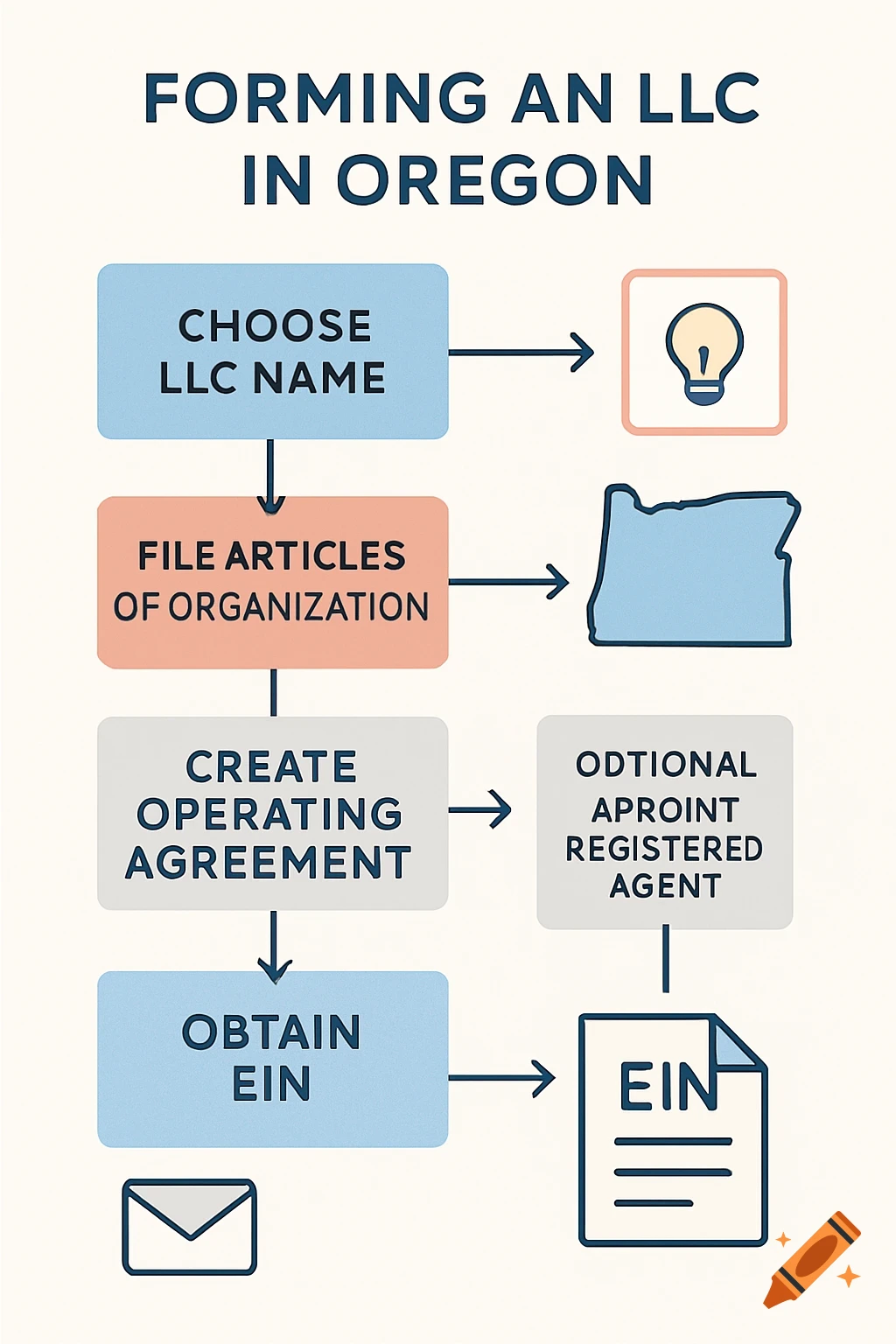

A simple infographic flowchart detailing the steps to form an LLC in Oregon, with text boxes and icons.

START | v 1. Choose an LLC Name | |--- (Optional: Reserve Name? Yes) ---> File Application for Name Reservation ($100) | | | v | Name Reserved for 120 days | | |--- (Optional: Reserve Name? No) | v 2. Designate a Registered Agent (Must have physical Oregon address) | v 3. File Articles of Organization with Oregon SOS ($100 fee) | |--- (Online or Mail) | v 4. Create an Operating Agreement (Highly Recommended, not legally required) | v 5. Obtain an Employer Identification Number (EIN) from IRS (Free, required for multi-member LLCs or employees) | v 6. Fulfill Ongoing Legal Obligations | |--- File Annual Report with Oregon SOS ($100 fee) | |--- Obtain Necessary State and Local Licenses/Permits | |--- Understand Federal and State Tax Obligations | |--- File Beneficial Ownership Information (BOI) Report with FinCEN (within 90 days for new businesses) | v END See more