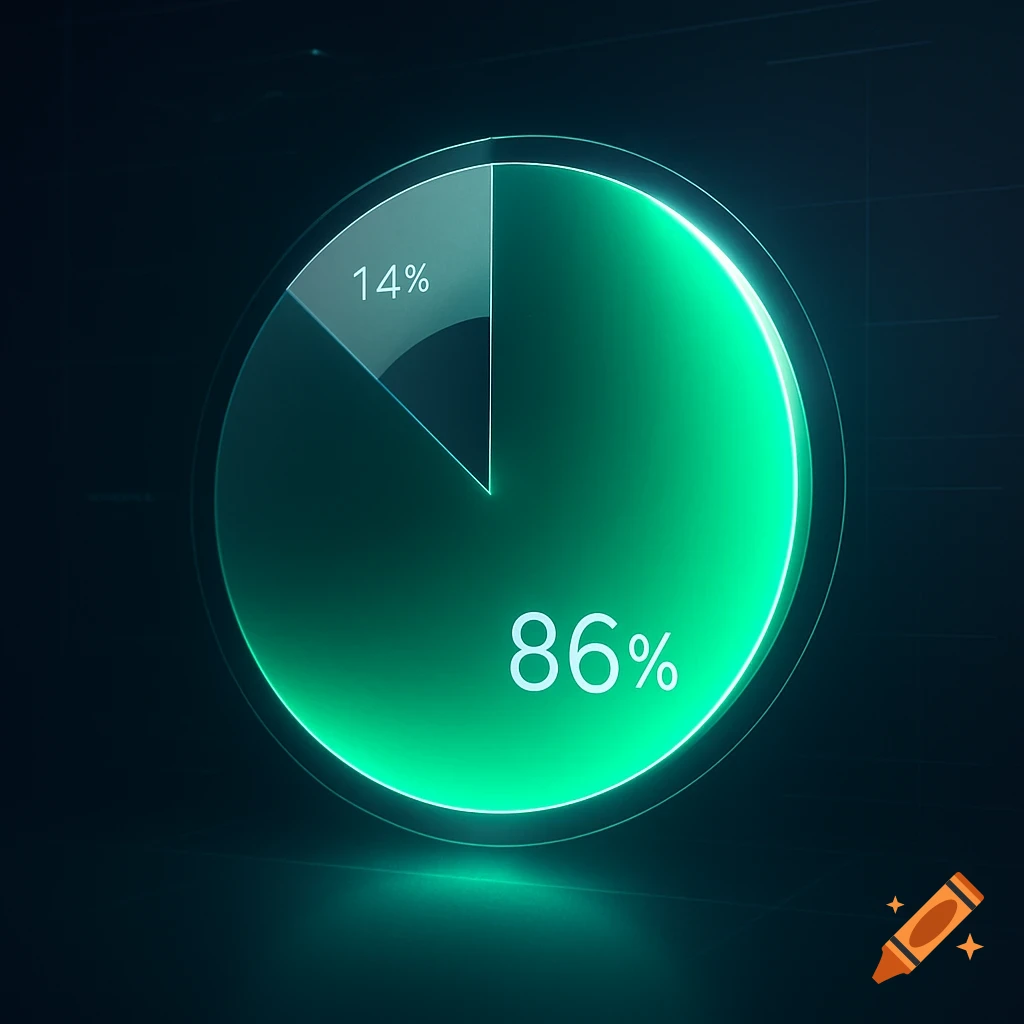

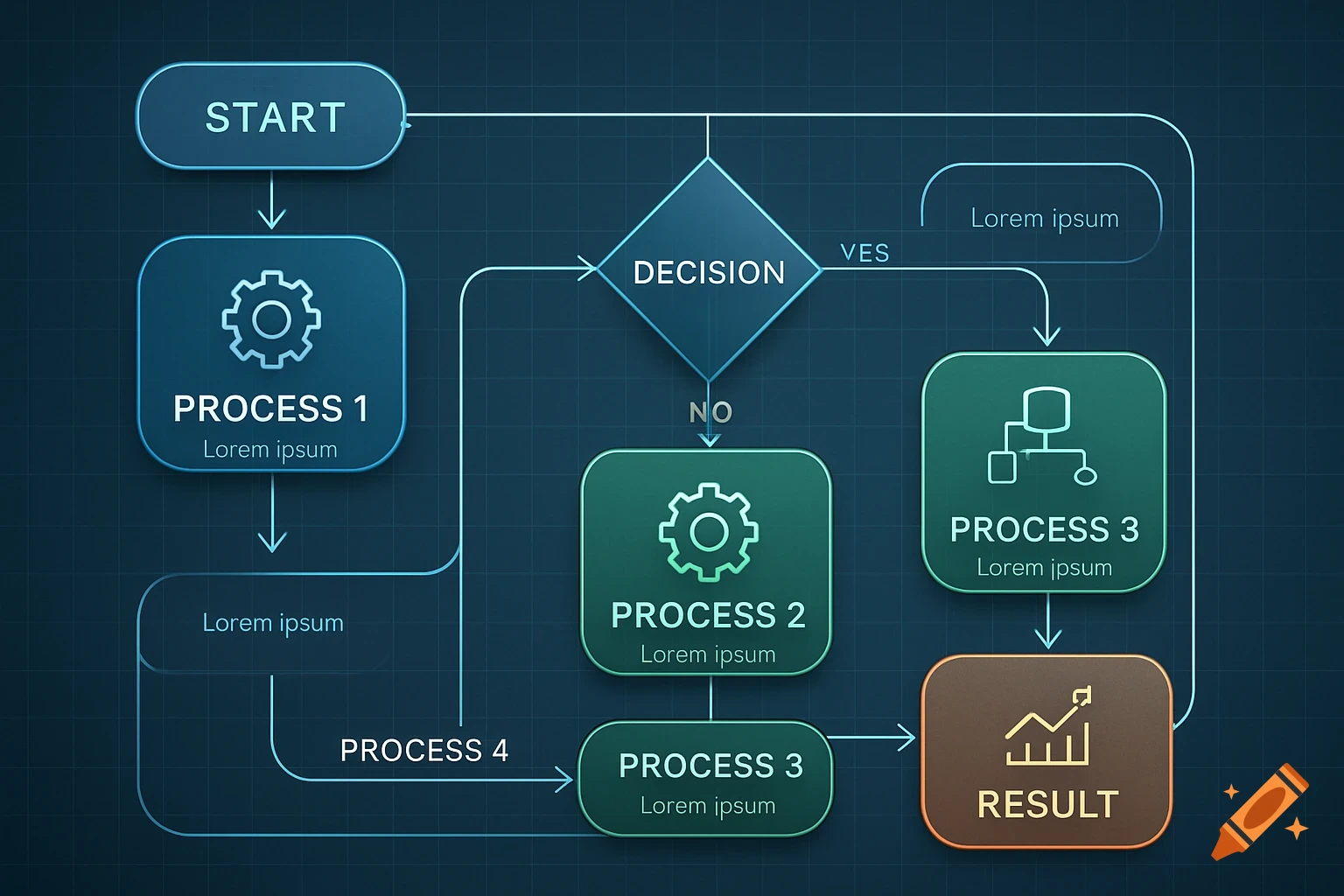

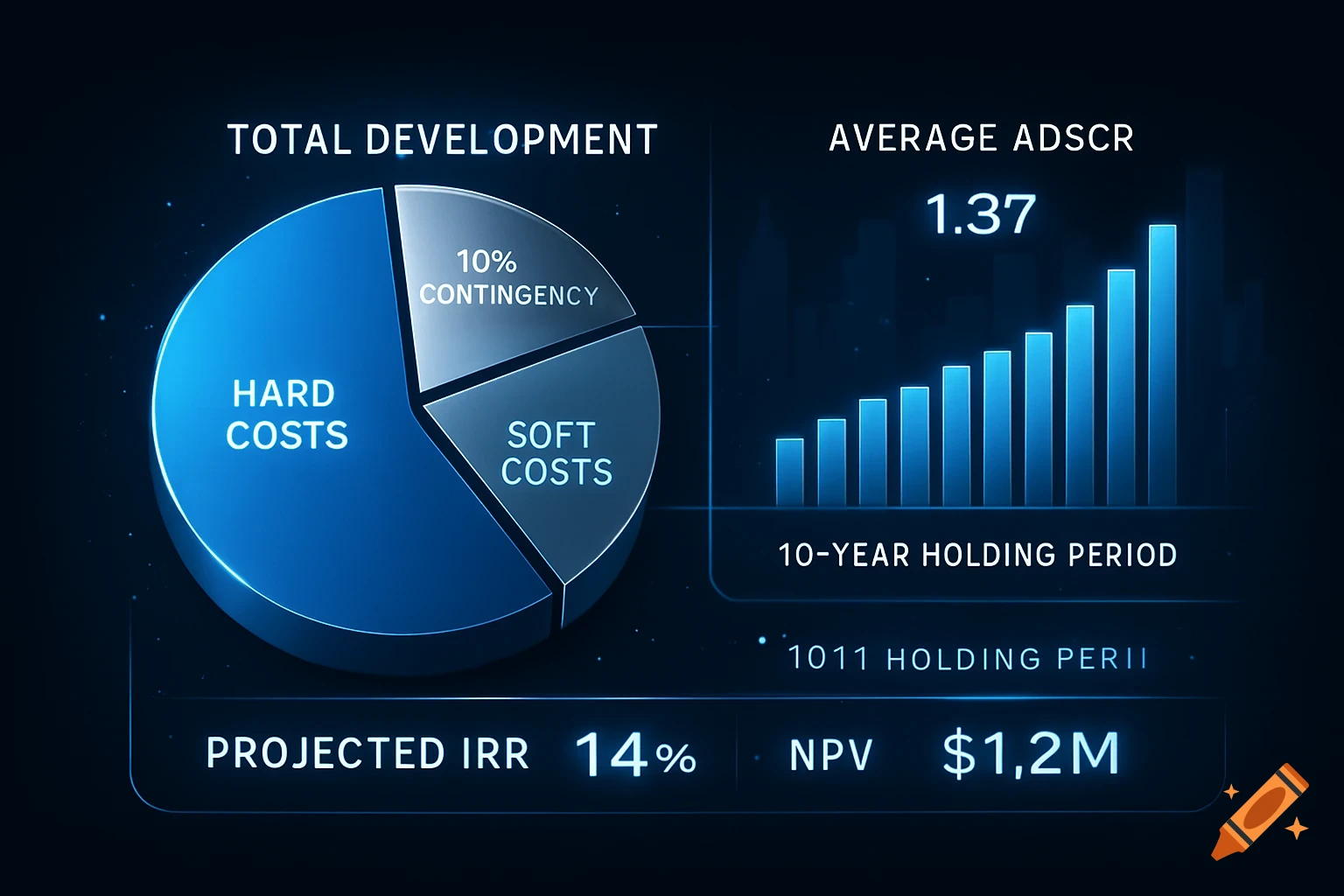

A dark blue financial dashboard with a pie chart showing total development costs split into hard costs, soft costs, and 10% contingency, and a bar chart showing average ADSCR of 1.37 over a 10-year holding period, with projected IRR of 14% and NPV of $1.2M.

Development Costs: The proposed plan is projected to require $2.7 million in total development costs, inclusive of both hard and soft costs + a 10% contingency. The project demonstrates a strong resilience with an average ADSCR of 1.37 over the 10-year holding period. The project estimates an investment return of Internal Rate of Return (IRR): 14% Net Present Value (NPV): $1.2M Generate an stats image for the above given numbers See more