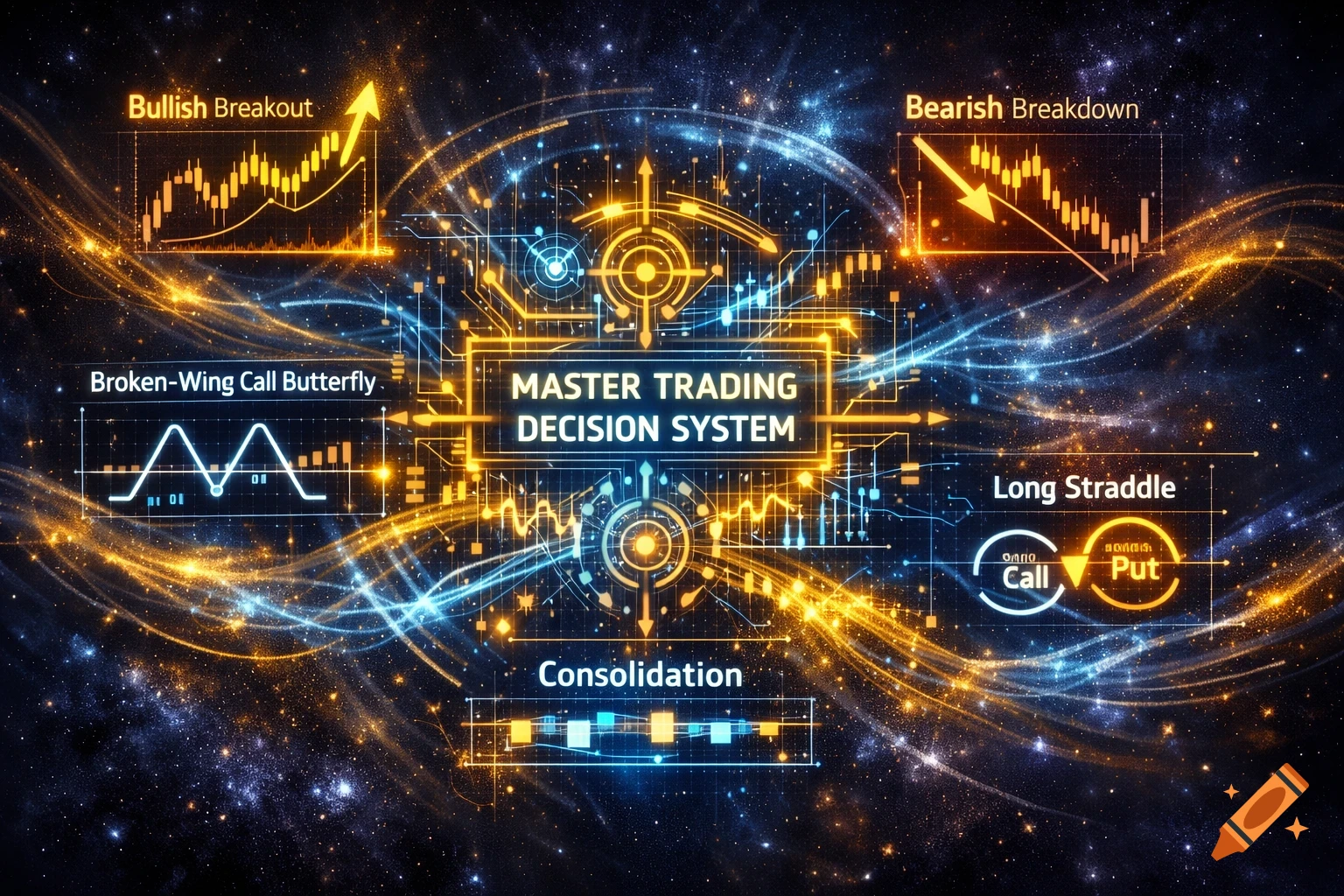

A glowing, futuristic diagram of a 'MASTER TRADING DECISION SYSTEM' in space, surrounded by circuit patterns and charts for 'Bullish Breakout,' 'Bearish Breakdown,' 'Broken-Wing Call Butterfly,' 'Long Straddle,' and 'Consolidation' strategies.

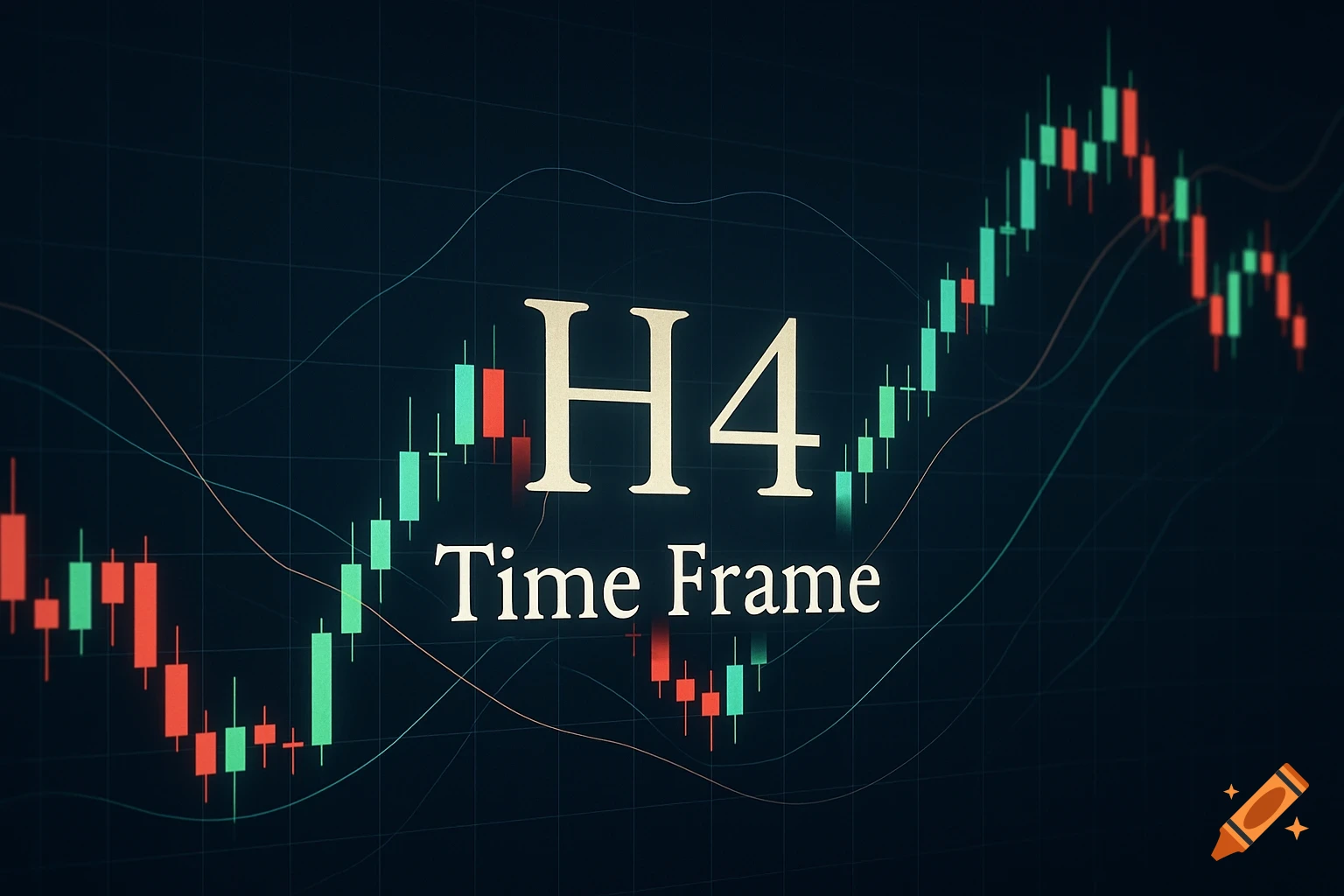

📘 MASTER TRADING DECISION SYSTEM Strategies • Timing • Strike Selection • Weekly Calendar • Pre‑Market Routine 🟦 1. PRICE‑ACTION DECISION CHECKLIST A. If Price Breaks Above Resistance Volume above average RSI rising but < 70 MACD bullish crossover Candle closes above resistance Trend intact (higher highs/lows) Strategy: Broken‑Wing Call Butterfly Expiration: 14–45 DTE Goal: Capture explosive upside with limited risk B. If Price Breaks Below Support Volume spike RSI falling but > 30 MACD bearish crossover Candle closes below support Trend intact (lower highs/lows) Strategy: Broken‑Wing Put Butterfly Expiration: 14–45 DTE Goal: Capture breakdown acceleration with limited risk C. If Price Enters Tight Consolidation Bollinger Bands narrow Volume dries up MACD flattens Market waiting for catalyst Strategy: Long Straddle Expiration: 7–30 DTE Goal: Profit from volatility expansion in either direction 🟦 2. ADVANCED OPTIONS STRATEGIES (LIMITED RISK, UNLIMITED UPSIDE) 🔵 A. Broken‑Wing Call Butterfly (Bullish Breakout) Structure Buy 1 ATM call Sell 2 calls above Buy 1 call further above (skip a strike) Strike Example (Stock at $100) Buy 100C Sell 2 × 105C Buy 115C Expiration 21–30 DTE for normal breakouts 14–21 DTE for earnings/catalysts When to Close Price stalls near 105 → take 50–70% Breakout fails → exit < 7 DTE with no move → close When to Roll Price blasts above 115 → roll up/out Need more time → roll to 30–45 DTE 🔵 B. Broken‑Wing Put Butterfly (Bearish Breakdown) Structure See more